P60 Apostille

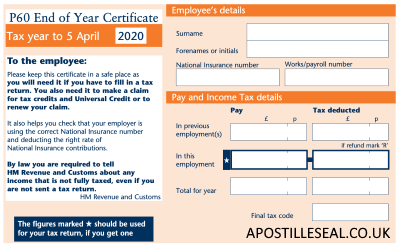

P60 Apostille is a statement issued by an employer to an employee at the end of april each tax year. It shows the amount of income tax and National Insurance (NI) contributions.

Can be used overseas or country’s representatives eg: Embassy, Consulate, Employment, Overseas tax deduction.

Apostille Legalisation for P60 can be attached to the original or electronic certificate.

P60 Apostille Legalisation

A P60 is a document that explains how much you’ve earned over the tax year and it also includes how much you’ve paid in National Insurance contributions and Pay As You Earn (PAYE) income tax.

What type of P60 we can legalise with an apostille?

The original P60 document cannot be duplicated, so please retain this in a safe place. We can attach the apostille on regular original documents, electronic or printed form. All options require Solicitor/Notary certification prior to apostille legalisation.

The P60 includes the following information:

• The employee’s name and address

• The employer’s name and address

• The tax year covered by the P60

• The employee’s gross pay

• The amount of income tax deducted

• The amount of NI contributions deducted

• The employee’s National Insurance number

• The employee’s PAYE tax code

The Apostille P60 is important for a number of reasons. It can be used to:

• Claim back any overpaid tax

• Apply for tax credits

• Provide proof of income for a mortgage or loan application

• Check that the correct amount of tax has been deducted

If you lose your P60, you can request a replacement from your employer. You can also access your P60 information through your personal tax account on the HMRC website.

Here are some of the reasons why you might need your P60 apostille:

• To claim back overpaid tax. If you think you have paid too much tax, you can use your P60 to calculate how much you are owed. You can then submit a claim to HMRC.

• To apply for tax credits. Tax credits are a government payment that can help low-income families and individuals. You will need to provide your P60 when you apply for tax credits.

• To provide proof of income for a mortgage or loan application. When you apply for a mortgage or loan, you will need to provide proof of your income. Your P60 can be used to do this.

• To check that the correct amount of tax has been deducted. If you are concerned that the wrong amount of tax has been deducted from your pay, you can use your P60 to check the figures.

P60 Apostille

Value 10-12 Days- GOV FEE

- ADMIN FEE

- FREE CHECK

Apostille P60

Standard 6-8 Days- GOV FEE

- ADMIN FEE

- FREE CHECK

Apostille P60

Fast 3-5 Days- GOV FEE

- ADMIN FEE

- FREE CHECK

P60 Apostille

Next Day Legalisation- GOV FEE

- ADMIN FEE

- FREE CHECK

How to legalise?

P60 Apostille in the UK

Legalise ONLINE

Book online and send the booking confirmation with the document need to legalised by post

Legalise by FORM

- Print and fill the Order Form with your details

- Post your documents with the Order Form to us

- We legalise your documents and post back to you

- Postal address is written on the top of the form

- If you do not have a printer then please post your document to us with your details written down (Name, Email, Telephone and Return Address)

- Payment can be made by Debit/Credit Card on the invoice, Bank transfer, Cheque, Postal Order, Paypal, etc.

Where you may need the P60 apostilled?

- Proof of fiscal residency

- Double taxation avoidance

- Proof of employment or employment history

- Embassy’s/Consulate

- Mortgage or loan

We offer fast service, accurate translations for:

- Business Documents

- Corporate Legal

- Health & Medical

- Manufacturing

- Travel & Tourism

- P60 Apostille Translation

Document Translation Services

- Any language

- Fast. Accurate. Confidential. Affordable.

- Accredited/Certified Translators

- All industries and subject matter

- Personalized services

- Translation of Documents and Written Materials